The IRS conducts audits to ensure that individuals and businesses fulfill their tax responsibilities accurately. The IRS audit letters are among the critical components of IRS audits, which are essential to understand for successfully navigating the audit process and preventing potential legal issues, but where do IRS Audit Letters come from?

Given the complexities of U.S. tax laws, it’s common for individuals and businesses to find themselves overwhelmed, potentially missing crucial details related to their tax obligations. This is precisely what our dedicated team at Greenberg Law Group is all about. We provide expert guidance to individuals and businesses, ensuring that everything is noticed and minimizing the risk of encountering problems with the IRS and the law.

Now, let’s delve into the essence of IRS audit letters, exploring their key components–what they entail, where they come from, what an IRS audit letter looks like, and ways to reduce the likelihood of running into problems with the authorities.

Where Do IRS Audit Letters Come From?

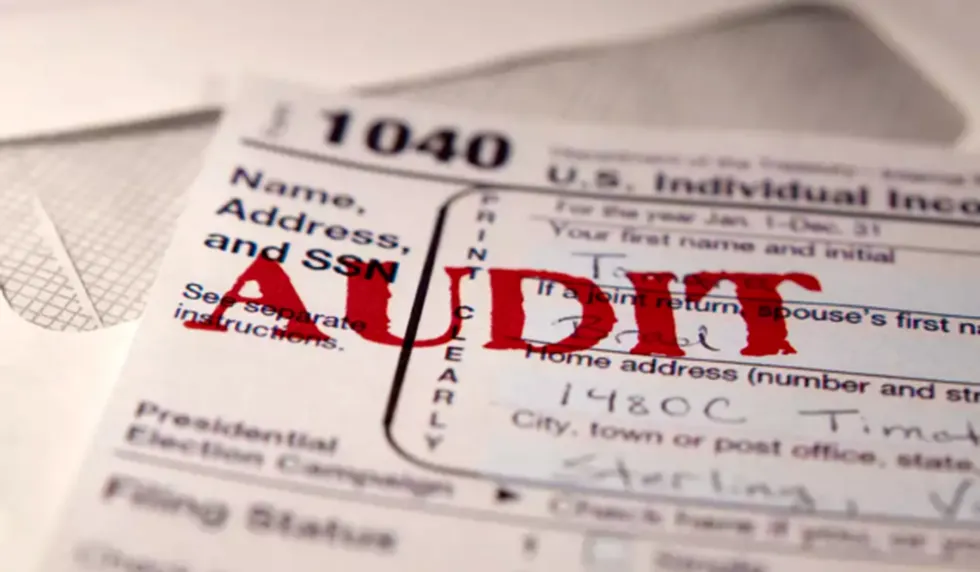

An IRS audit letter is a formal notification alerting taxpayers that their tax returns are under review. These audits comprehensively examine financial details, including income, deductions, and credits. The primary goal of an audit is to verify the accuracy of the reported information and ensure compliance with tax laws.

There are various reasons why individuals and businesses may receive IRS audit letters. The IRS may select taxpayers randomly as part of their effort to ensure tax compliance. Additionally, high-income individuals, those engaged in high-risk activities (such as high-risk investments), specific industries, non-filers, or those with discrepancies in their information may also be subject to audits.

What does an IRS audit letter look like?

To gain a clearer understanding of what an IRS audit letter entails, let’s delve into its visual characteristics:

IRS Letterhead and Official Contact Information

IRS letters include the official IRS logo and letterhead—a key sign that the communication is legitimate and not a scam. The IRS also provides their contact information, including a phone number. You can confirm the authenticity by reaching out to them directly. This ensures you are dealing with official government correspondence and not a fraudulent entity.

Taxpayer Identification and Tax Year

In addition to name and address, taxpayers can be identified by their social security number, taxpayer identification number (TIN) or Employer ID Number (EIN), and the tax year(s) under review. Taxpayers need to check and verify the accuracy of the information contained in the IRS audit letter. If any details, like your address, have changed, promptly inform the IRS to ensure precise record-keeping.

Reference Number and IRS Employee Contact

The audit letter also includes a reference number, which you can utilize for tracking and inquiries. Additionally, it provides contact details for the assigned IRS representative overseeing the audit, including their name, phone number, and address.

The Key Components of an IRS Audit Letter

Understanding the content of an IRS audit letter is crucial, as it comprises key components that demand careful attention:

1. Explanation of Issue or Discrepancy

The IRS will clearly state the reason for initiating the audit. This could stem from various issues, such as failing to report all income sources, including earnings from investments or freelance work. Other common mistakes include misrepresenting deductions, such as mixing personal and business expenses or losses.

This underscores the importance of thoroughly understanding the diverse tax laws and identifying which ones are relevant to your specific situation.

2. Request for Additional Information

When conducting the audit, the IRS may request documentation related to the issues under investigation. These documents include receipts, bills, loan agreements, employment documents, medical records, logs, tickets, and legal papers.

Take the time to understand the specifics of what they are asking for, organize your documents, and either mail in copies (not the originals) or bring the copies if the audit is conducted in person. Timely and thorough responses are essential to avoid delays and legal complications.

3. Deadlines and Consequences of Non-Compliance

Responding promptly to the specified IRS deadline is of utmost importance. Failure to meet these deadlines can result in severe legal consequences, including substantial fines and legal actions. Timely compliance avoids penalties and demonstrates professionalism, leaving a positive impression on government agencies like the IRS.

Request a confirmation when using a delivery service to ensure your documents reach the IRS on time. This precautionary step helps you track the delivery, preventing potential issues if there are delays or the mail doesn’t reach its destination on time.

How to Respond to an IRS Audit Letter

In addition to promptly providing the necessary documents and responses, there are further steps to help you respond effectively to IRS audit letters.

- Upon receiving the letter, carefully examine the information it contains.

- Organize the documents thoughtfully, ensuring they are clear and easy to follow.

- When submitting the information, double-check its accuracy and completeness to the best of your knowledge.

If there’s any uncertainty regarding U.S. tax laws or the IRS requests, consider seeking professional assistance from Greenberg Law Group. Our team will ensure that your response to the IRS letter is comprehensive, addresses any confusion, and handles legal matters appropriately. Professional support provides a well-informed and complete resolution to the audit process.

Avoiding Future IRS Audit Letters

While it’s impossible to guarantee that the IRS won’t audit you, there are several best practices you can follow to reduce the chance of an audit and ensure that your tax return is accurate and compliant:

- Ensure the completeness, accuracy, and timeliness of your tax returns. This involves accurately reporting all sources of income and maintaining a clear separation between personal and business finances.

- Organize and retain all your records for future reference, as evidence, and to support your claims. Moreover, stay informed about tax laws, understand their nuances, and identify which ones apply to your specific situation.

- Consider seeking professional assistance. Have your tax return reviewed by professionals to ensure compliance with the relevant U.S. tax laws, preventing future issues with the law and the IRS.

End Note

IRS audits are initiated for various reasons, and an IRS audit letter is a formal notification indicating that your tax returns are under review. Responding with confidence, clarity, and punctuality is crucial to avoid legal consequences and fines.

The complexities of complying with diverse U.S. tax laws and navigating the intricacies of an IRS audit can be daunting. This is where our team at Greenberg Law Group steps in to assist. We are the experts in tax-related matters, ensuring a smooth and hassle-free tax filing experience for businesses and individuals alike. Contact us now to learn how we can be your trusted partner in navigating IRS audits and tax obligations.