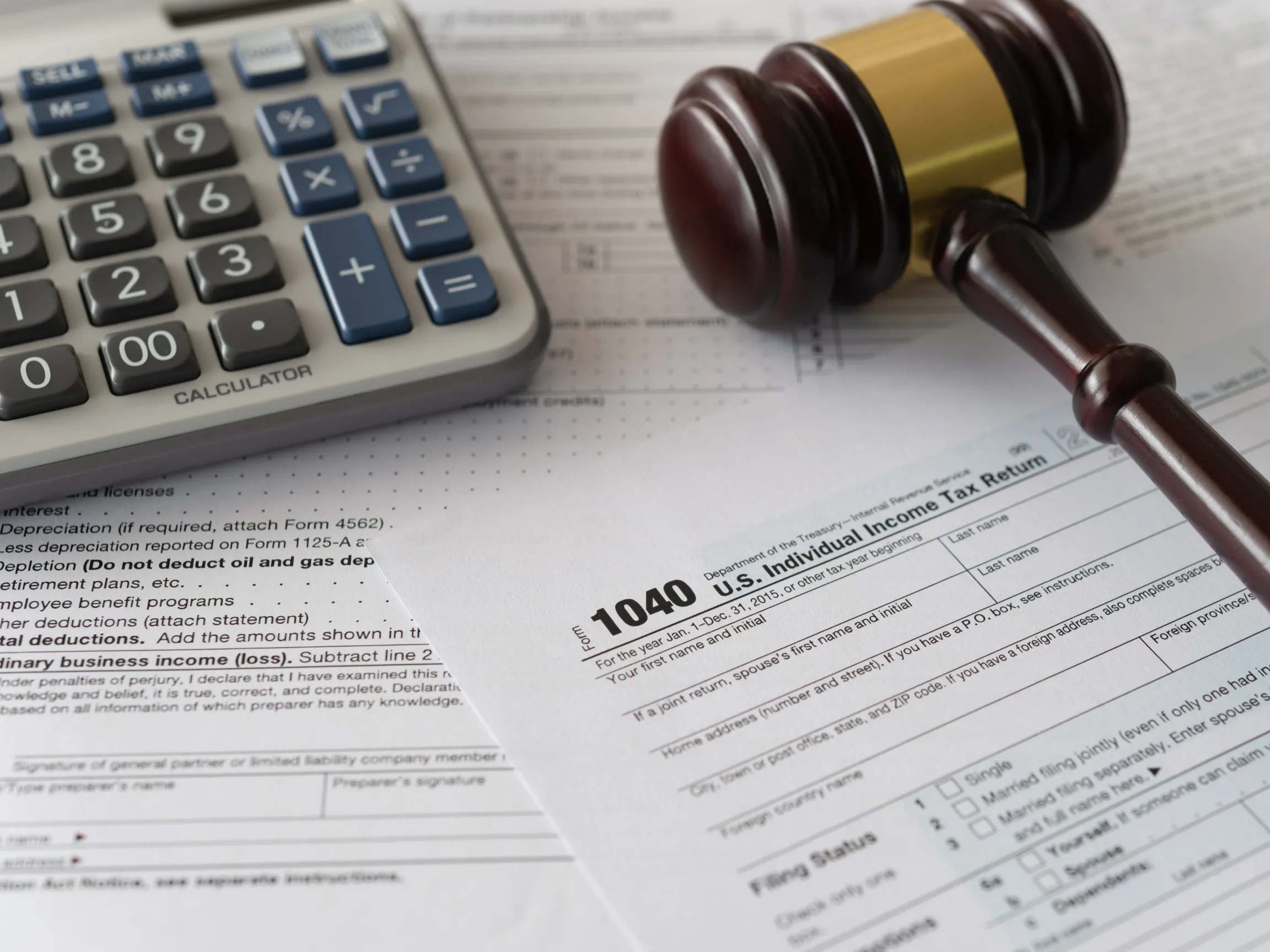

If you have experience dealing with taxes, you have likely been suggested to contact a tax law attorney. Why is that? What does a tax law attorney do? This article will dive into the role of tax attorneys and how they can be the best choice for you when facing different types of tax matters–from filing taxes to responding to IRS letters to negotiating with tax authorities. Read on to learn more.

The Role of a Tax Law Attorney

Definition and Purpose

A tax attorney is a legal professional who assists and represents an individual or business in tax-related matters. This encompasses everything from advice to planning to negotiation and representation in court.

Given the complex nature of tax regulations, a representation with skills and experience, such as a tax attorney, becomes a crucial partner in achieving a favorable outcome from tax-related affairs.

Common Areas of Practice

Tax attorneys cover a wide and substantive areas of practice. However, there are two main areas: transactional tax and controversial tax.

Transactional tax deals with issues that arise from mergers and acquisitions (M&A) and other transaction-based problems. In this case, tax attorneys help advise on structuring entities and transactions to minimize tax burdens. Examples include tax planning for individuals and businesses or estate and wealth transfer.

Controversial tax, on the other hand, deals with litigation and audits, where tax attorneys help prevent escalation of issues by, for example, effectively responding to and negotiating with the IRS. This can be individual tax issues like tax audits or levies, responding to IRS letters, and applying for an Offer in Compromise (OIC).

Key Responsibilities of a Tax Law Attorney

Understanding the responsibilities of a tax attorney is key to answering the question, “What does a tax law attorney do?”

Tax Planning and Compliance

A tax attorney can help clients in effective tax planning, ensuring no significant obligations are missed and maintaining full compliance with the latest tax regulations. Tax planning also allows individuals or businesses to structure and optimize taxes to lessen tax burdens.

Representation in Disputes

Dealing with tax disputes requires effective organization, communication, and negotiations. A tax attorney, as a representative, will handle all the processes mentioned above and will work hard to achieve a desirable outcome.

Legal Advice and Consultation

One of the key responsibilities of a tax attorney is to provide legal advice and consultation, which is crucial in preventing tax issues in the first place. By providing a complete understanding of the most updated tax regulations, a tax attorney helps clients maintain compliance with tax laws.

Estate Planning and Wealth Management

Dealing with estate and wealth management is a delicate issue and can be a complex matter. Tax attorneys specializing in estate planning can help draft legal documents, create trusts, and advise on further estate tax issues.

When to Hire a Tax Law Attorney

Knowing when to hire a tax law attorney is crucial in preventing any tax issues from becoming more complex problems that can lead to severe consequences. If you’re facing situations such as IRS audits, tax debt disputes, tax fraud, estate planning, and tax business issues, seek legal assistance immediately.

Signs You Need Professional Help

Tax regulations are complex. Not only that, they often change, and keeping up with these changes can be tricky. If you’re unsure about your tax obligations and everything about it seems confusing, this is the right time to seek professional help.

Trying to deal with tax matters when you’re unsure or don’t understand what it entails can be troublesome, further complicating the issues. By hiring a tax attorney, you can better grasp your specific tax issues and prevent the risk of penalties and litigations.

Benefits of Hiring a Tax Law Attorney

Expertise and Knowledge

A tax attorney is an experienced individual who has undergone extensive studies and training and is dedicated to tax laws. As a result, they have invaluable knowledge and expertise in navigating different tax situations. With their skills, clients have the best representation they can get when dealing with tax issues.

Stress Reduction and Peace of Mind

Having someone by your side who knows the ins and outs of tax regulations can provide you with peace of mind. Dealing with tax issues can be stressful, and letting the professionals handle the hassles and complexity allows you to put your effort into focusing on other important things in your life.

Increased Chances of Favorable Outcomes

Getting a favorable outcome requires effective negotiations and ensuring that no important details are missed, such as when responding to an IRS letter, filing your taxes, or applying for an installment agreement. Increased your chance of getting a positive outcome by hiring a tax attorney.

Choose the Right Tax Law Attorney

Achieving the benefits we have discussed also lies in selecting the right tax law attorney. This includes having an attorney with the right specialization that matches your specific tax issue.

Moreover, you also want to ensure that the tax attorney you want to represent you is of high quality. This means having the right credentials and qualifications and a good track record of success.

At Greenberg Law Group P.A., we are ready to assist you with different tax issues! Contact us and let us solve your tax situation as best as possible and get the best outcome for you!