When it comes to tax obligations, the IRS has the authority to take severe measures against those who fail to comply. One such action is a levy, where the IRS can legally seize assets, including wages. In this blog, we’ll answer the question ‘What is a wage levy?’, how to respond if you’re facing one, and most importantly, how to prevent it from happening in the first place. Let’s get started.

What is a Wage Levy?

A wage levy is a legal action the IRS takes to address unpaid taxes directly from an individual’s wages. The process involves the IRS issuing a wage levy to the taxpayer’s employer, instructing them to withhold a portion of the taxpayer’s wages or salary and remit it to the IRS to settle the outstanding tax debt. This continues until the debt is cleared, alternative payment arrangements are made, or the levy is lifted.

This action is legally mandated by the IRS to ensure compliance with tax laws.

The Process of a Wage Levy

1. IRS Notification Process

Before resorting to levies, the IRS follows a series of steps to notify taxpayers and offer opportunities to resolve their overdue taxes. Initially, taxpayers receive notifications reminding them of their outstanding tax debt and presenting various repayment options, such as installment plans, Offer in Compromise, or appeals through a Collection Due Process (CDP) hearing.

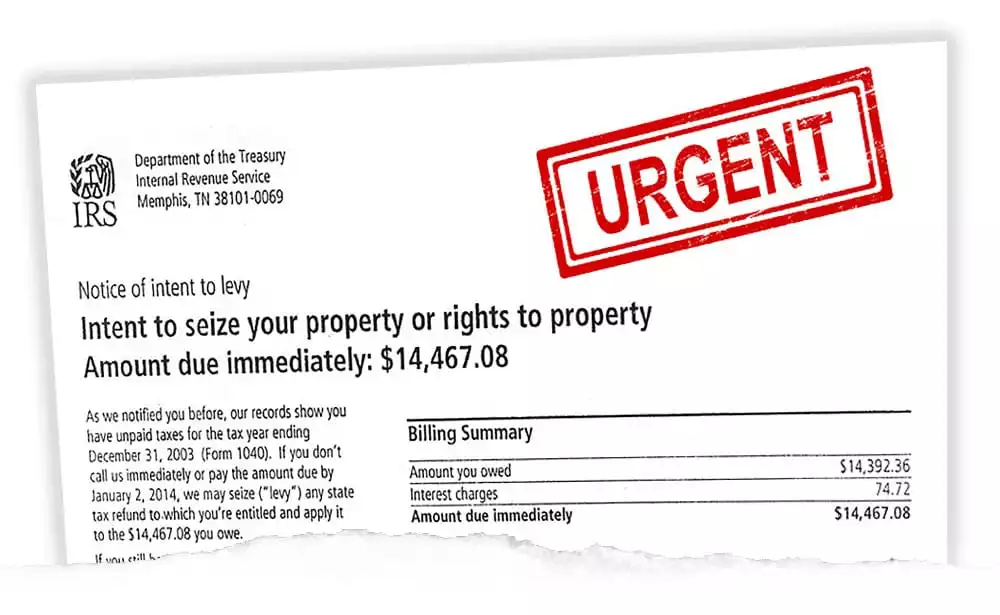

If the taxpayer takes no action, the IRS issues a Final Notice of Intent to Levy, serving as a final warning to taxpayers. This notice signals the IRS’s intent to seize taxpayer assets if immediate action is not taken to address the outstanding tax debt.

2. Employer’s Role in a Wage Levy

When the IRS issues a wage levy to an individual’s employer, the employer is legally required to comply with the instructions outlined in the levy notice. This involves informing employees about the levy and the amount withheld from their wages.

Additionally, the employer must remit the withheld funds to the IRS according to the specified timeline provided in the notice. To ensure compliance, employers may need to complete certain documentation related to the levy, such as Form 668-W. Employers must adhere to IRS regulations and deadlines throughout the wage levy process to avoid facing penalties or legal consequences.

3. Calculation and Amount

When the IRS initiates a wage levy, it considers multiple factors such as the taxpayer’s income, filing status, dependents, and standard deduction. Additionally, there are limits on the amount the IRS can levy, typically to ensure that the taxpayer retains enough income for essential living expenses. So essentially, the IRS aims to implement a wage levy that aligns with taxpayers’ ability to pay while ensuring they can afford necessities.

Impact of a Wage Levy

The impact of a wage levy is detrimental to anyone. Financially, a wage levy can substantially reduce the taxpayer’s income, as a portion of their wages is withheld by their employer and sent directly to the IRS to satisfy the tax debt. This reduction in income can lead to financial strain and potential hardships.

In the long term, wage levies can damage credit scores and financial reputations, making it hard to access loans or credit cards. Furthermore, the strain on relationships between employers and employees can create tension in the workplace and even threaten job security. All of these factors contribute to immense stress for those affected. That’s why responding to IRS notices effectively and promptly is crucial.

How to Respond to a Wage Levy

Dealing with taxes and the IRS can be incredibly complex and overwhelming. When faced with a wage levy, seeking professional help is crucial. With the assistance of experts, you can ensure you respond appropriately to the situation, maximizing your chances of achieving the best possible outcome.

While paying off the debts entirely is ideal, it may not always be feasible. Fortunately, there are various options available to resolve the issue, such as arranging installment agreements, negotiating an Offer in Compromise, claiming economic hardship to reduce payments, or having your debt classified as Currently-Not-Collectible.

Each option has benefits, and determining the best course of action for your circumstances can be challenging. That’s where a tax attorney can be invaluable. They can provide detailed explanations of each option and help you choose the one that best suits your needs.

End Note

So there you have it–the answer to the burning question: what is a wage levy? It’s essential to understand that the IRS holds the legal authority to seize your assets, including your wages if you fail to respond to their notices and settle your debts using the options provided. We sincerely hope you never find yourself in this situation.

However, if you do, it’s crucial to comprehend the process and how to respond effectively. Partnering with a professional tax attorney can significantly improve your chances of navigating a wage levy successfully and achieving the best possible outcome for your situation.

If you’re facing tax-related challenges or have concerns about a wage levy, don’t hesitate to reach out to us at Greenberg Law Group, P.A. Our team of experienced tax attorneys has been assisting clients in dealing with the IRS for over 20 years, and we’re here to help you too.