What is an Offer in Compromise?

When you cannot pay your tax debt in full, the IRS offers several options to help ease the financial burden. One of those options is an Offer in Compromise (OIC). Understanding this option can help anyone struggling with tax debt as it provides a potential pathway to financial relief and can prevent more severe consequences.

So what is an Offer in Compromise? And how exactly can it assist in resolving your tax debt? Read on to learn more about this option for taxpayers.

What is an Offer in Compromise (OIC)?

An Offer in Compromise is a program provided by the IRS that allows taxpayers to pay their tax debt for less than the total amount owed. This option is designed to help those facing financial hardship manage their tax debt and regain financial stability.

There are specific criteria and eligibility requirements for an OIC. The IRS considers several factors when evaluating OIC applications:

Ability to pay: The IRS assesses your overall financial standing, including your income and expenses, to determine your ability to pay the tax debt.

Income: Both your current income level and any potential future income are taken into account.

Expenses: The IRS evaluates your expenses to ensure they’re reasonable and justifiable

Asset Equity: Your assets, such as vehicles, investments, and real estate, are also considered.

In addition to these criteria, applicants must also meet the following requirements:

- You must have filed all required federal tax returns and made all required estimated payments. The IRS will not consider your OIC application if you haven’t met these obligations.

- You cannot be in an open bankruptcy proceeding.

- You must be current with all required tax payments for the current year.

- If you own a business with employees, you must have made all required federal tax deposits for the current quarter and the past two quarters before applying.

Types of Offer in Compromise

Doubt as to Liability (DATL)

A Doubt as to Liability (DATL) offer is used when taxpayers dispute the accuracy of their tax debt. If you believe there is a genuine error in the amount owed, you can apply for a DATL by filing Form 656-L.

However, it’s important to note that you cannot dispute DATL if the tax debt has been established by a court decision regarding the amount of the assessed tax debt or if the assessed tax debt is based on existing law.

To support your claim, you’ll need to provide a written statement explaining why you believe there’s an error in the amount owed, along with any supporting documents or evidence.

Doubt as to Collectability (DATC)

A Doubt as to Collectability (DATC) is the most common type of Offer in Compromise. It’s used when taxpayers cannot afford to pay their full tax debt. When reviewing a DATC application, the IRS considers the individual’s income, expenses, and assets to determine if there is doubt that the total amount owed can be collected. If the IRS finds reasonable doubt, the debt may be settled for a lesser amount.

Effective Tax Administration (ETA)

Those who can technically pay their entire tax debt but would face economic hardship by doing so can apply for an Effective Tax Administration (ETA) offer. This type of Offer in Compromise (OIC) is designed for situations where collecting the total amount would be unfair or inequitable. To qualify for an ETA, you must demonstrate that paying the full tax debt would create significant financial difficulties and provide evidence that requiring full payment would be unjust or unfair based on your specific circumstances.

Benefits of an Offer in Compromise

An Offer in Compromise offers several benefits. The primary advantage is settling your tax debt for less than the full amount owed, including penalties and interest. This can help individuals avoid more aggressive collection actions by the IRS, such as bank levies, property seizures, and wage garnishments. These actions will be halted once a deal is in place with the IRS and the agreed amount is paid. Reducing your tax debt can provide a fresh start and an effective resolution to your tax issues with the IRS.

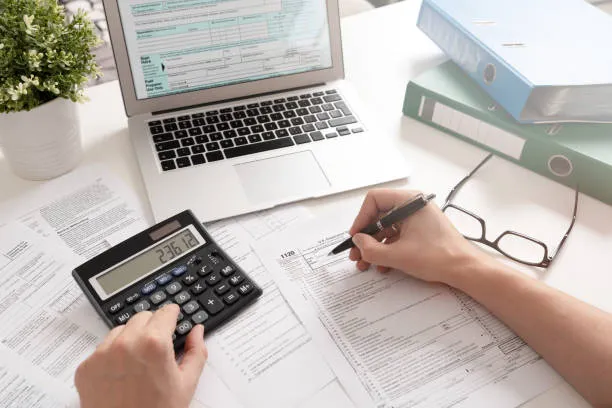

Process of Submitting an Offer in Compromise

If you meet all the criteria and requirements mentioned earlier, you can start applying for an Offer in Compromise (OIC) that suits your needs.

First, gather all the necessary documentation, including financial statements, tax returns, and other relevant documents. Next, fill out IRS Form 656 and IRS Form 433-A (for individuals) or Form 433-B (for businesses), along with the required application fee of $205 and the initial offer payment based on your chosen payment option:

Lump Sum: You must submit at least 20% of your proposed offer. If the IRS approves your offer, you can pay the remaining balance in five or fewer installments.

Periodic Payment: Keep paying the remaining balance in monthly installments while the IRS reviews your offer. If the IRS accepts your offer, continue making monthly payments until the total amount is paid off.

After submission, the IRS will review your offer. During this time, you may be required to provide additional information or documentation to support your case. Be prepared for potential negotiations with the IRS regarding the terms of your offer.

Tips for Success with an Offer in Compromise

Now that you have answered the question, “What is an Offer in Compromise?”, it’s time to find out how to succeed with one. While you can negotiate an OIC with the IRS yourself, hiring a qualified tax attorney can make the process smoother and increase the chances of a favorable outcome. Handling such complex procedures requires focus, meticulous organization, and knowing the right things to say during negotiations, which is crucial for achieving the desired result.

With Greenberg Law Group P.A., you don’t have to worry. Our team is experienced with OIC submissions and negotiations. We’re ready to assist you with different types of OICs and any specific needs you have.

When undergoing the Offer in Compromise process, be honest and thorough in disclosing financial information to the IRS. Failing to do so can not only ruin your chances of getting your application accepted but also potentially land you in more trouble. Additionally, follow the IRS guidelines and instructions carefully to ensure compliance with OIC requirements.

End Note

What is an Offer in Compromise? An OIC presents a viable solution for those unable to pay their tax debt fully. With various types of OICs tailored to different financial situations, it is imperative to approach the application process with precision and thoroughness. Successfully negotiating an OIC with the IRS can significantly reduce your debt, offering you the opportunity to regain financial stability and start anew. This is why it’s advisable to seek professional assistance to maximize your chances of approval.

Greenberg Law Group P.A. specializes in OIC applications and can provide the expertise and guidance necessary to ensure your submission is accurate and comprehensive. Get in touch with us today to discover how we can help you navigate the complexities of the OIC process and get started as soon as possible!