Our Guide To IRS Payment Plans

If you’re facing taxes and don’t seem to be able to pay them in full right away, the IRS payment plans may be your suitable solution.

The government, through the IRS, offers options to help taxpayers who owe the federal government settle their debts and prevent further tax problems.

Continue reading to learn more about what IRS payment plans are, how to apply for them, and how they can help you manage your tax debts.

What Is an IRS Payment Plan?

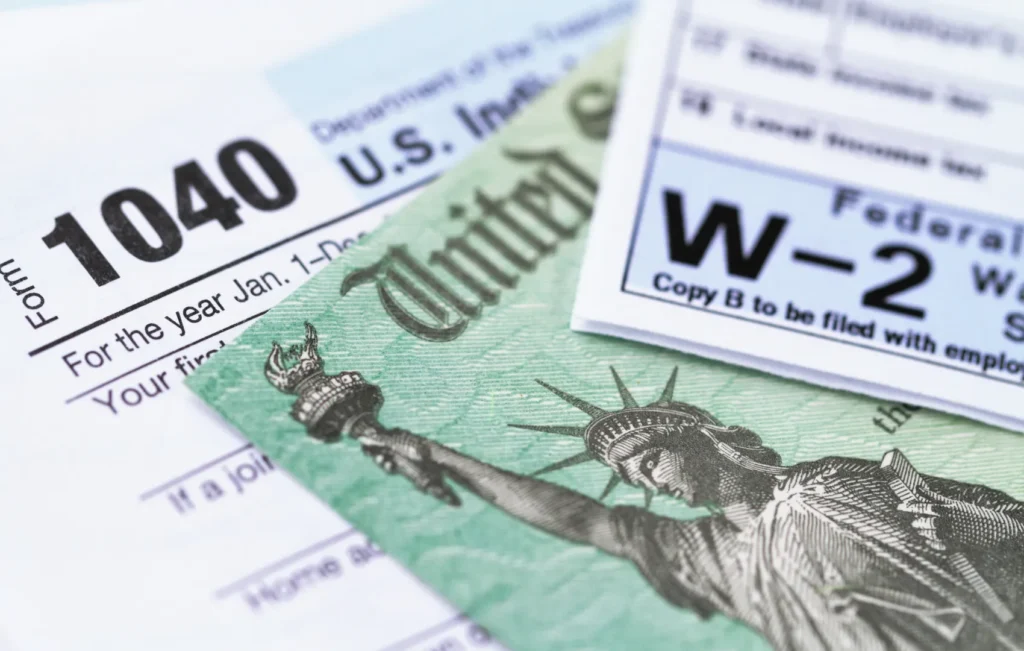

IRS payment plans, also known as IRS installment agreements, are tax-settlement options that allow taxpayers to pay tax debts in installments rather than all at once.

These IRS payment plans are designed to ease the financial burden for those having a hard time paying off their debts right away, helping them manage their tax debts more efficiently.

Another advantage of installment agreements is that they prevent aggressive tax enforcement actions (levies, liens, wage garnishments), provided the taxpayers remain compliant with the agreement.

Who Qualifies?

Anyone who owes federal taxes and cannot pay in full may apply for an IRS installment agreement. However, approval of which agreement depends on the amount owed, filing status, and ability to pay.

On the other hand, those with a history of repeated default on prior IRS payment plans, unfiled tax returns, and a significant outstanding balance (typically over $50,000) may be denied or require extensive documentation.

Types of IRS Payment Plans

Short-Term Payment Plan

The first type of IRS payment plans is a short-term plan. This payment plan requires the taxpayer to pay the full amount (including penalties and interest) within 180 days. Failing to do so will force you to change to a long-term payment plan or face severe consequences.

While those with any amount of debt can apply for a short-term payment plan, due to the nature of the deadline, it’s suitable for taxpayers with smaller debts or temporary cash flow issues, who need a little extra time beyond the original due date.

Eligibility includes not being in an open bankruptcy status and having filed all required tax returns. Payments are flexible with no required fixed monthly amount. However, it’s recommended to make partial payments to reduce the interest that accrues.

Long-Term Payment Plan (Installment Agreement)

A long-term payment plan, often called an Installment Agreement (IA), is an IRS payment plan available to those who owe less than $50,000 and cannot pay in full within 180 days.

Requirements include having filed all current and the last five years’ tax returns, not in a bankruptcy proceeding, and having no recent default on an IRS payment plan.

Taxpayers who have over $50,000 in debt can still apply for an IA. However, stricter requirements, such as providing detailed financial statements and undergoing an IRS review, apply.

The installment agreement term length is whichever comes first — up to 72 months or until the collection statute expires. Payment is made in fixed monthly installments, with the minimum payment equal to the total amount owed divided by 72 months.

An installment agreement is suitable for those who need ample time to pay off debts and who need to pause any further actions by the authority, such as collection actions.

Subtypes:

The Individual Installment Agreement and the Business Installment Agreement are other subtypes of IRS installment agreements available.

An individual installment agreement is specifically for personal tax debt (e.g., Form 1040 liabilities) and is the default for most wage earners or self-employed individuals. Single, jointly filers, and sole proprietors owing income tax can apply for an individual installment agreement.

A business installment agreement is tailored for businesses owing entity-level debts, like payroll or corporate taxes, to help keep operations running. Sole proprietors, partnerships, LLCs, or corporations with tax liabilities (besides personal debts) are recommended to apply for a business installment agreement.

Other requirements include less than $25,000 in outstanding debt, all business returns filed, and no open bankruptcy.

Partial Payment Installment Agreement (PPIA)

A partial payment installment agreement is a more advanced agreement reserved for those owing larger debts or experiencing financial hardship, where standard installment agreements aren’t feasible.

PPIA is also designed for those who aren’t able to fulfill their tax settlements within the IRS’s 10-year Collection Statute Expiration Date (CSED)—the period during which the IRS can collect the debt.

PPIA allows taxpayers to make partial payments based on what they can afford monthly. Eligibility for this type of plan requires full financial disclosure, detailed IRS analysis, and approval. There’s also a chance the IRS will forgive the remaining balance if it expires before full repayment is made.

How to Apply for an IRS Installment Agreement

There are several ways to apply for an IRS payment plan: online, by mail, by phone, or with legal representation.

For speed and lower fees, apply online. Applying by phone or mail takes 30-60 days. The best option to take is to seek legal representation to ensure accuracy and efficiency, especially if you’re unsure or dealing with significant tax or financial issues.

Whichever option you choose, you’ll need to provide information such as the amount owed, the tax year(s) involved, monthly income and expenses, assets, liabilities, etc.

Fees and Interest Associated with IRS Payment Plans

Setup Fees

| Type of Payment Plan | Setup Fee (approx.) |

| Online Direct Debit | $31 |

| Online Non-Debit Payment | $130 |

| By Phone/Mail | $107 – $225 |

| Low-Income Waiver | Reduced or waived |

Ongoing Costs

While IRS installment agreements are a good option to help you manage your tax debts, note that there are ongoing costs that come with them. Firstly, there is daily interest on the unpaid balance, which, over time, can increase the final bill more than the original debt. Any late payment will also incur penalties that can add up significantly. Penalties are typically 0.5% of the unpaid taxes per month.

What Happens If You Miss an IRS Payment?

Missing a payment will not automatically end your plan. However, missing too many payments can result in a default, which will terminate your plan and resume any collection actions that were halted under the agreement.

The best way to prevent termination of the agreement and further issues is to ensure payments are made on time; if you miss a payment, act quickly to make it up.

How Greenberg Law Can Help with IRS Installment Agreements

Greenberg Law Group is an expert in tax matters, including tax debts and IRS installment agreements.

We’ll help guide you through every corner of navigating your tax issues and ensure that every detail isn’t missed and that the outcomes are the best you can achieve.

For more details, please contact us today. We look forward to assisting you with your tax matters, whether it’s a basic or more complex issue; we’re up for it!

FAQs About IRS Payment Plans

How long can an IRS payment plan last?

Most long-term installment agreements can span up to 72 months (6 years), depending on the amount owed.

Will an IRS payment plan hurt my credit?

The IRS does not report to credit bureaus, so your credit score isn’t directly impacted. However, tax liens (if filed) can appear on public records.

Can I negotiate the monthly payment amount?

Yes, primarily if your financial situation supports a lower amount — but documentation is required.

A sales tax holiday aims to reduce costs for consumers, increase sales for retailers, and boost local economies overall. For example, a sales tax holiday is frequently used in many states for back-to-school shopping and

A sales tax holiday aims to reduce costs for consumers, increase sales for retailers, and boost local economies overall. For example, a sales tax holiday is frequently used in many states for back-to-school shopping and